Entrepreneurs with a view to starting a new business form a separate legal entity; they…

How to file your own income tax return online

STEPS TO FILE QUICK ITR-1

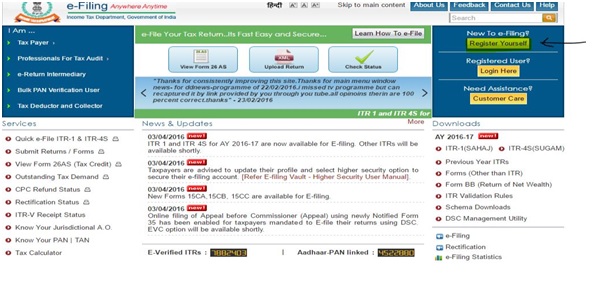

Step 1: Go to http://incometaxindiaefiling.gov.in/

Step 2:

- Click on Register Yourself if you have never registered your PAN online in previous year’s.

- Else click on “Login here” icon as shown in the image below.

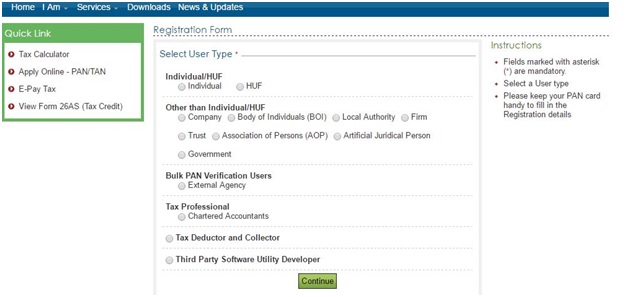

Select the appropriate option.

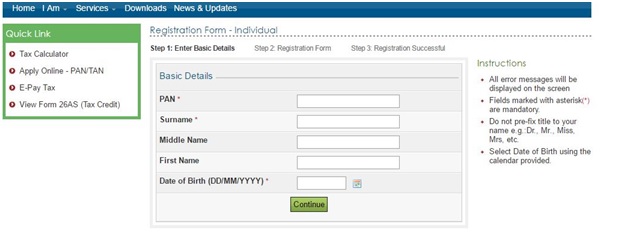

- Incase you have never registered your PAN online in previous year’s follow below :

After you have registered yourself a link is sent to the email address mentioned by you and OTP on your cell number. Activate by clicking on the link and entering the OTP if required.

Fill in the necessary details.

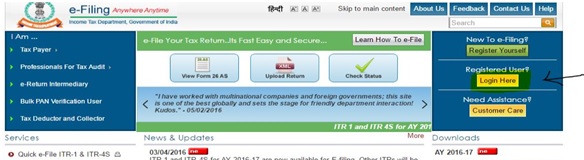

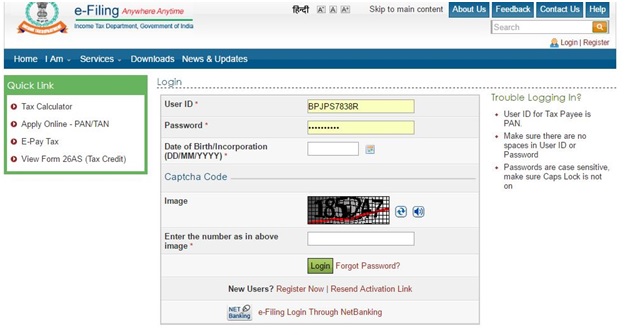

- If you are already a registered user click on “Login here”, following screen will open :

User ID is your PAN number and password is the one that you created while registering yourself. Fill the other details on screen and click “ Login”.

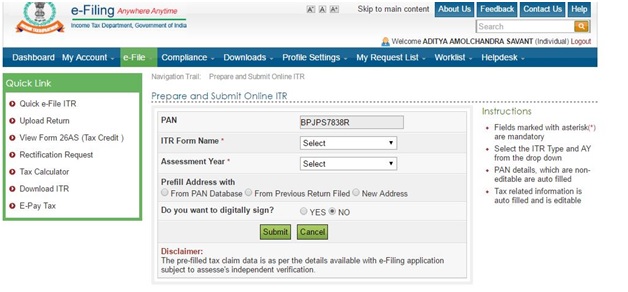

Step 3: After you login, following screen will appear:

Click on “Quick e-File ITR” on left hand side of the screen. (highlighted in yellow part in above image).

Step4: Select the appropriate ITR Form name and Assessment year for which the ITR is to be filled.

If you are filling the return for the first time then click on Prefill address with “From previous return filed” or else click on “From PAN database”.

Select the digital signing option if you have a DSC.

Click on “Submit”.

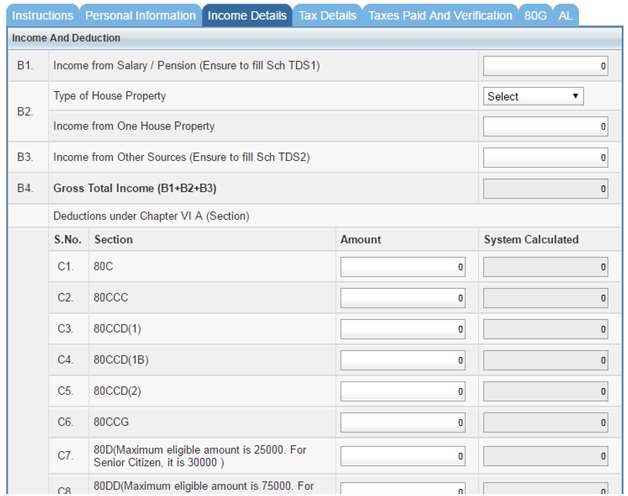

Step 5: Fill the Form completely. Put your income details and other personal information in the respective tabs.

Click on “Submit” after you fill all the details. Fill the Salary details as per form 16 in the “Income Detail” tab in the “income from Salary” cell. Mention the amount mentioned on your form 16 after deduction of “professional tax” or “employment tax”. Mention the interest income on saving account and fixed in “income from other sources” cell. Mention “Income from house property” in the cell; incase of interest on loan for house property negative amount. Mention the amount of saving u/s 80C and 80D. Please cross verify account details are required to be provided for all bank accounts. It is mandatory as per Income Tax to disclose all bank account details. TDS details will flow automatically in the “Tax Details” tab.

Step 6: Check if it is a refund to you or tax payable to the Govt.

Refund is transferred to your bank account mentioned.

Incase tax payable then follow below :

If you have internet banking facility then you can pay the tax from there or else follow below:

- Download challan 280 to pay tax from this link http://www.incometaxindia.gov.in/forms/107010000000345598.pdf

- Fill the challan details.

- Pay this challan in any bank and take the receipt from the banker.

- Continue filling the quick ITR.

- Mention the details of the receipt that you got from the banker in the “Tax Details” Tab in ITR form as shown below:

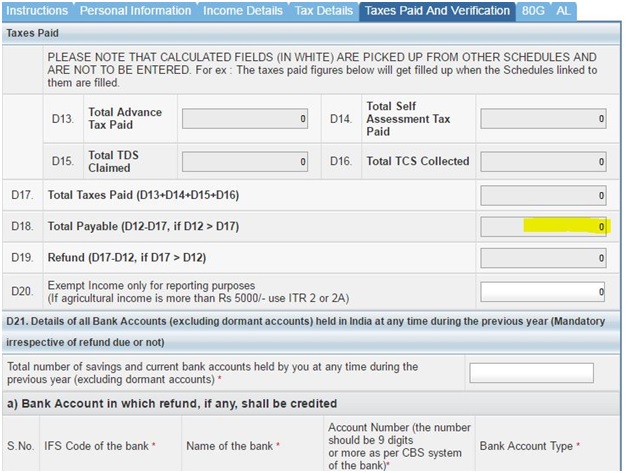

- Now confirm whether the amount payable is NIL in the “Taxes paid & Verification” Tab as below:

- Submit the return once you confirm “total Payable” Becomes NIL.

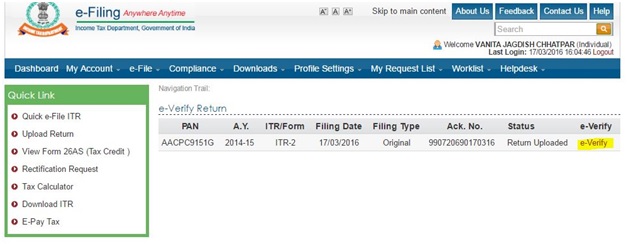

Step7: After you submit your return, go to “e-file” tab, In that go to “e-Verify Return”.

Click on “e-verify” shown as above.

Step 8: Select the appropriate option to e-verify your return.

( In case your return does not get verified, kindly send the signed copy to “Income Tax Department – CPC, Post Bag No – 1, Electronic City Post Office, Bengaluru – 560100,Karnataka”)

In order to download your return, go to “My account” tab, e-filed returns & forms:

Step 9: Click on the “Ack. No.” and download your return.

Password for the return is combination of your PAN no and date of birth in lower case (small letters) without any space or symbols.

For eg. Your PAN no. is AAASG5987N and date of birth is 07/08/1957, then password for the file is aaasg5987n07081957.

Step 10: Your return has been filed. Click on “Logout” at the right hand side corner.

This Post Has 0 Comments